Capital planning is one of the most strategic responsibilities of a facilities leader. It determines which assets will be funded, which projects move forward, and ultimately, how the organization balances risk, compliance, and performance. Done right, it secures long-term stability. Done poorly, it results in mounting backlogs, reactive decisions, and costly surprises.

The difference between the two often comes down to data.

The Challenge: Competing Needs, Limited Budgets

In most organizations, capital needs far exceed available resources. Tight budgets force tough choices, and facilities teams often find themselves fighting for funding without the right information to justify their case.

In healthcare alone, deferred maintenance has reached critical levels. According to Facility Health Inc., the average healthcare facility has 41% of its infrastructure assets operating beyond their useful life, a gap projected to widen if capital investment trends don’t change.

The barriers to effective planning are consistent:

- Data silos that fragment asset, condition, and budget information across multiple systems

- Reactive cultures that only fund what’s already failed

- Competing priorities among departments vying for attention

- Budget uncertainty driven by fluctuating material and labor costs

Without a structured, data-backed approach, capital planning becomes a yearly negotiation rather than a long-term strategy.

Building the Foundation: Forecasting with Confidence

Forecasting is where credibility begins. The more accurately you can predict capital needs and costs, the stronger your business case becomes.

To forecast effectively:

- Leverage historical data: Use past spending trends on replacements and major repairs to set realistic baselines.

- Track asset lifecycles: Knowing where equipment stands in its useful life helps anticipate replacements before they fail.

- Include hidden costs: Account for safety upgrades, compliance requirements, and downtime risks, not just the sticker price.

- Model scenarios: Develop different funding levels, from essential compliance to optimal investment, to show tradeoffs.

- Factor escalation: Adjust for inflation in materials, labor, and energy to ensure future estimates stay accurate.

When facilities leaders can explain how each cost is derived, and connect it to real performance data, they establish trust with financial stakeholders.

From Raw Data to Prioritized Action

Data alone isn’t enough. The power lies in how it’s used to prioritize projects objectively.

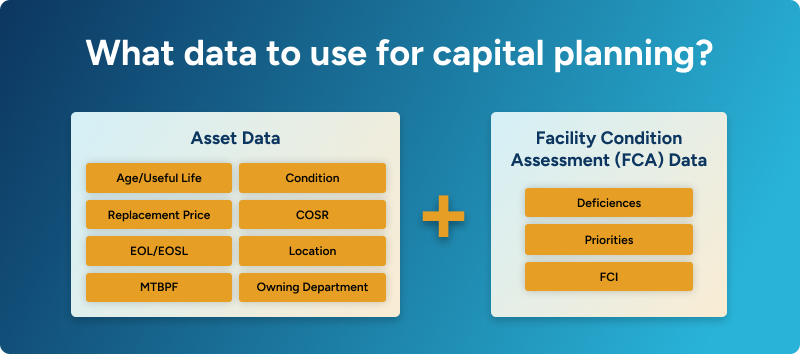

By combining asset data with facility condition assessment data, leaders can rank projects based on risk, compliance impact, cost, and strategic alignment.

Asset Data Examples

- Age and remaining useful life

- Replacement price

- Reliability (MTBF or failure frequency)

- Safety and compliance costs (COSR)

- Location and criticality

- Departmental ownership and impact

- Facility Condition Assessment Data

- Documented deficiencies

- Priority ratings for urgency and severity

- Facility Condition Index (FCI) scores to benchmark building health

Pro tip: Manually scoring projects in spreadsheets is time-consuming and mistakes are easy to make. Nuvolo’s Capital Planning & Projects product eliminates that risk by running asset and FCA data through an automated scoring algorithm, producing a clear, prioritized capital plan with accuracy you can trust.

Making Capital Planning a Continuous Roadmap

The most effective capital plans aren’t one-time exercises. They evolve with new data, shifting priorities, and changing costs.

Approaching capital planning as a continuous, data-informed cycle keeps leaders ahead of risk and aligned with organizational goals.

A Sustainable Capital Planning Process

- Consolidate information across asset data, FCAs, and financial systems.

- Define evaluation criteria for how projects are scored including safety, ROI, energy efficiency, compliance, or mission impact.

- Develop funding scenarios to prepare for varying budget levels.

- Engage stakeholders early, especially finance, to ensure agreement on priorities, funding levels, and evaluation criteria.

- Connect investments to business outcomes such as ESG commitments, occupant experience, or regulatory compliance.

- Monitor actual vs. planned spend, and use completed project data to refine future forecasts, adjust lifecycle assumptions, and fine-tune funding priorities.

This approach transforms capital planning into a living roadmap — one that demonstrates foresight, discipline, and alignment across the organization.

Earning Trust Through Data

When capital decisions are guided by accurate, transparent data, facilities leaders shift from requesting funds to advising on strategy. They can clearly articulate why a project matters, how it supports broader goals, and what the financial return looks like over time. By embracing data as the foundation for capital planning, facilities teams build more than budgets, but credibility too. And with that credibility comes influence, efficiency, and the ability to turn insight into lasting wins.

Related Reading

Capital planning is just one part of becoming a more strategic facilities leader. Continue building your leadership toolkit with our Best Practices for Facilities Management blog, a guide to developing the influence, foresight, and skills that drive operational success.

Download “The Ultimate Facilities Playbook” for practical, expert-backed solutions to your top facilities pain points.

Download GuideDownload “The Ultimate Facilities Playbook” for practical, expert-backed solutions to your top facilities pain points.

Download Guide